With a single click you can quickly see your profit & loss, balance sheet, and dozens of other reports. Set up recurring payments for automatic bill pay that’s hassle-free. Because you have a proper bookkeeping system in place, you won’t have to worry about the types of accounts assignment help homework help online live two situations and other business presentations you must make.

- That’s why QuickBooks’s ability to account for the current exchange rate is very helpful.

- Your account will automatically be charged on a monthly basis until you cancel.

- Not only can you determine your store’s current state, but you can also use the data you’ve gathered to spot trends and profitable opportunities.

- The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets.

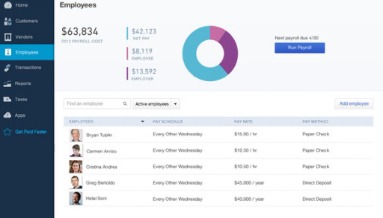

Each employee is an additional $4/month for Core, $8/month for Premium, and $10/month for Elite. Contractor payments via direct deposit are $4/month for Core, $8/month for Premium, and $10/month for Elite. If you file taxes in more than one state, each additional state is $12/month for only Core and Premium. The discounts do not apply to additional employees and state tax filing fees.

To fix or prevent this from happening, you must change the sync options in the app to allow it to bring over a daily summary instead of individual transactions. Create invoices, take photos of receipts or see your company’s activities from the QuickBooks mobile app anytime, anywhere. Managing your business’s financial health is one of the most crucial parts of establishing any successful company and brand. Not only can you determine your store’s current state, but you can also use the data you’ve gathered to spot trends and profitable opportunities. We take monthly bookkeeping off your plate and deliver you your financial statements by the 15th or 20th of each month.

How to integrate QuickBooks and Amazon Seller Central integration

Teton Wood Blooms is a small business that started as a hobby for April Preuss. Working with flowers carved from wood, Preuss creates flower bouquets and décor that provides a unique proposition to the wedding industry—florals that last a lifetime. Income, expenses, outstanding invoices, and other key business financials are on view as soon as you sign in. Sync data from popular apps like QuickBooks Time, Shopify, PayPal, and many others. QuickBooks is an exceptional accounting system for viewing your bookkeeping numbers. So whether you don’t have it yet or are already using it and want what is a special journal to integrate it, let Unloop shed some light on what you can do to produce those numbers easily.

QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Data access is subject to cellular/internet provider network availability and occasional downtime due to system and server maintenance and events beyond your control. Your account will automatically be charged on a monthly basis until you cancel.

Tax Filing Assistance

You’ll have your Profit and Loss Statement, Balance Sheet, and Cash Flow Statement ready for analysis each month so you and your business partners can make better business decisions. See articles customized for your product and join our large community of QuickBooks users. If you get interrupted during reconnection, go here to continue. Instantly see how your business is performing.

QuickBooks Online makes accounting easy

Requires QuickBooks Online mobile application. The QuickBooks Online mobile app works with iPhone, iPad, and Android phones and tablets. Not all features are available on the mobile apps and mobile browser.

If you add or remove services, your service fees will be adjusted accordingly. To be eligible for this offer you must be a new QBO and Payroll customer and sign up for the monthly plan using the `Buy Now” option. Unloop is the first and what is the difference between public companies and public sector only accounting firm exclusively servicing ecommerce and inventory businesses in the US and Canada. With the power of people and technology, our team dives deep into COGS and inventory accounting. You are paired with a dedicated bookkeeping team that prepares accurate financial statements, financial forecasts, and can also pay bills or run payroll for you. Come tax time, everything is organized and ready to go, so you don’t need to worry.

Your QuickBooks Account Can Calculate Your Amazon Sales Tax

Bookkeeping and accounting agencies understand this predicament. That’s why we handle the accounting aspects of your inventory to ensure you get the right COGS. This is crucial, especially when determining the correct net profit in your business’s income statement. That’s why QuickBooks’s ability to account for the current exchange rate is very helpful. It will determine the correct currency amount at the sale or purchase, giving you and your accounting staff accurate numbers and peace of mind. It’s just a matter of choosing one, setting up the integration, then getting someone to manage it (if you don’t want to do it yourself).